About Us

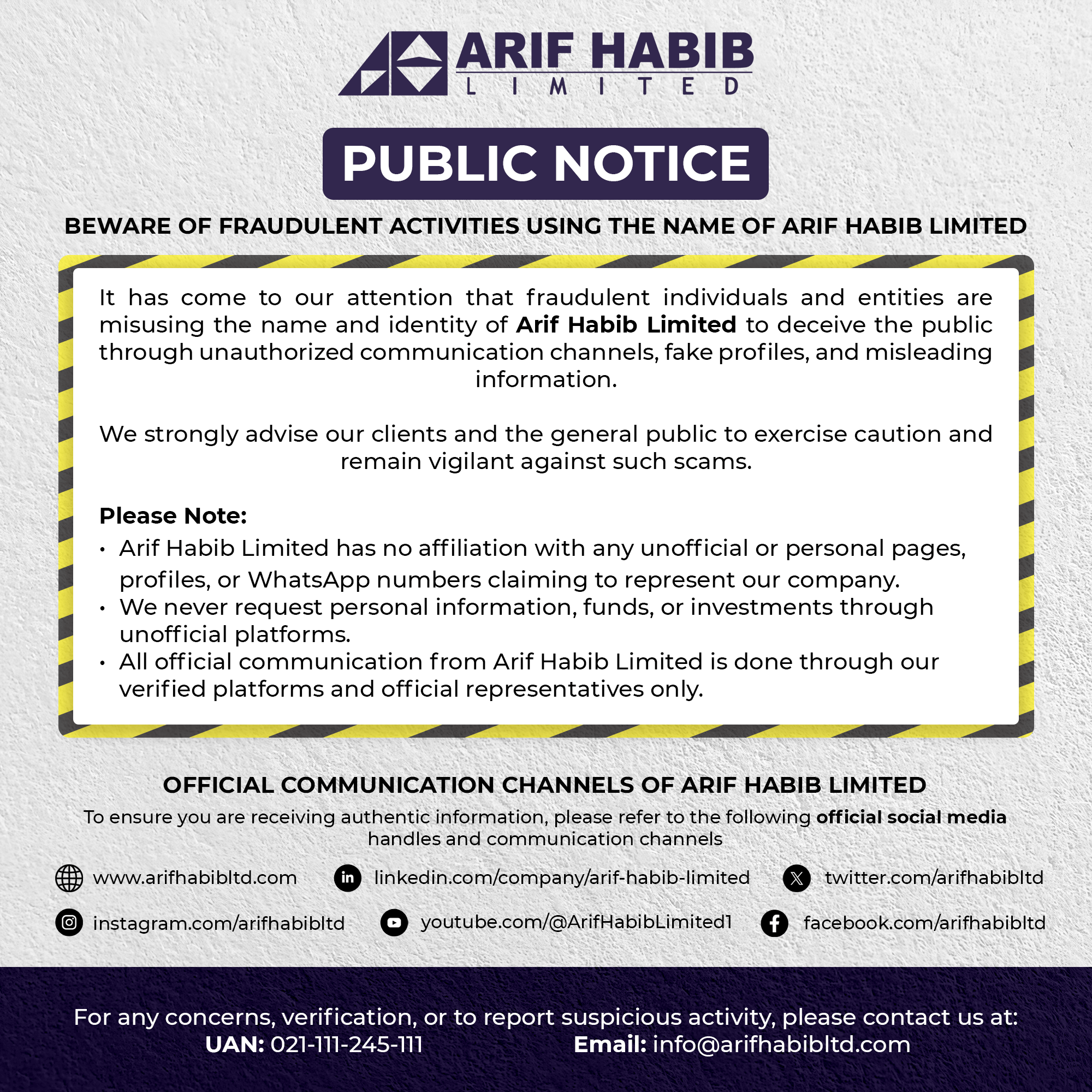

Arif Habib Limited (AHL) is Pakistan’s largest securities brokerage, investment banking, and research firm. Listed on the Pakistan Stock Exchange, AHL and is the only brokerage firm included in the Top 25 Companies of Pakistan Stock Exchange.

We provide a wide range of financial services to an extensive and diversified client base including the Government of Pakistan, corporations, financial institutions, multilateral organizations, and individuals.

AHL is part of the Arif Habib Corporation which is one of the leading business groups of Pakistan. The Company has an extensive and diversified portfolio across all major business sectors including Fertilizer, Financial Services, Construction Materials, Industrial Metals, Dairy Farming, and Energy.

AHL has won awards from Asiamoney, CFA Society Pakistan, FinanceAsia, The Asset AAA, Pakistan Stock Exchange & etc.

Governance

Arif Habib

Founder – Arif Habib Group

Mr. Arif Habib is the Chief Executive of Arif Habib Corporation Limited, the holding company of Arif Habib Group. He is also the Chairman of Fatima Fertilizer Company Limited, Aisha Steel Mills Limited, Javedan Corporation Limited (the owner of Naya Nazimabad) and Sachal Wind Power

details

Zafar Alam

Chairman & Independent Director

Mr. Zafar Alam is a Master’s degree holder in Nuclear Physics and has over 34 years’ experience in investment banking

details

Muhammad Shahid Ali Habib

Chief Executive Officer & Executive Director

Mr. Shahid Ali Habib carries a proven track record of establishing successful business organizations

detailsAwards & Recognition

- Best Broker - Capital Markets Awards 2025

- Best Investment Bank for M&A - 2025

- Best Bank for Research - 2025

- Best for Research in Pakistan – 2024

- Best for Diversity & Inclusion in Pakistan - 2024

- Pakistan's Best Investment Bank - 2023

- Best Broker Pakistan – 2025

- Best Equity Capital Market House Pakistan – 2025

- Best Investment Bank – Country Awards – 2022

- Best Broker - Country Awards - 2021

- Best Pakistan Deal - 2019, 2018, 2017

- Best Corporate Finance House of the Year – Equity and Advisory – 2025, 2023, 2022, 2021, 2019, 2018, 2017, 2016, 2015, 2014, 2013

- Best Equity Brokerage House – 2023, 2022, 2021, 2013

- Best Corporate Finance House - Fixed Income - 2023

- Best Economic Research House – 2023, 2022, 2021

- Investment Ideas Competition - 2023

- Transaction of the Year - 2019, 2017, 2015

- Best Research Analyst – 2022, 2021, 2020, 2018

- Best Equity Brokerage House Runner-up – 2025, 2024, 2019, 2014

- Best Economic Research House Runner-up – 2025, 2024

- Best Equity Sales Person - Runner up - 2024, 2023

- Best Equity Research Analyst - Runner-up – 2024, 2019

- Best Gender Equality Bond – 2024

- Best Equity Advisor - 2021

- Best Corporate & Institutional Advisor - 2021, 2020

- Best Brokerage House - 2019, 2018, 2017, 2016, 2015

- Best Equity Deal - 2019, 2018, 2017, 2016, 2015

- Best Bond Advisor - Asia Pacific region - 2020, 2019, 2018, 2017

- Best Bond Advisor – 2021, 2020, 2019

- Best IPO - 2019

- Best Secondary Share Placement - 2015

- Best Privatisation - Asia Pacific region - 2015

- Best Deal (UBL Share Placement) - 2014

- Best Securities House - 2022

- Best Investment Bank - 2022

- Most Outstanding Company in Pakistan – Financials Sector – 2021

- Best Corporate & Investment Bank - 2020, 2019

- Best Domestic Equity House - 2019, 2018, 2017, 2016, 2015

- Best Country Deal - 2019, 2018, 2017, 2016, 2015

- Best Research Coverage - 2016

- Best for Corporate Access (Individual) - 2023

- Best for Corporate Access (Brokerage) - Runner Up - 2023

- Best Execution - Runner up - 2023

- Best Overall Brokerage House - Runner up – 2025

- Best Money Market Brokerage House - Runner up – 2025

- Best Money Markets Conventional Brokerage House - Runner up – 2024

- Best Money Market Broker (Islamic) 2021

- Excellence Award for Best Financial & Equities House

- Best Brokerage House – 2023

- Most Innovative Financial Market Brokerage: 2022

- Most Trusted Forex Broker: 2022

- Best Forex Mobile App – AHL Tick App: 2022

- Best Equity House – Pakistan – 2022

- Top 25 Listed Companies of Pakistan by Pakistan Stock Exchange - 2019, 2018, 2017, 2016, 2015, 2014, 2012, 2008, 2007

- Excellence Award - Leading Brokerage House for RDA 2021

- Top IPO/SPO/Share Placement Financial Advisor - PSX IPO Summit - 2016, 2015

- Innovative IPO Instrument of the Year - PSX IPO Summit - 2016

- Book Runner of the Year - PSX IPO Summit - 2016

- Innovative IPO Instrument of the Year - PSX IPO Summit - 2014

- Book Runner of the Year - PSX IPO Summit - 2013

- Best Brokerage - 2019, 2018, 2017

- Best Corporate Finance Services Provider - 2019, 2018, 2017

- Transformative Technology Leader - 2021

Our Locations

Karachi

Islamabad

Lahore

Peshawar

Faisalabad

Multan

Arif Habib Foundation

The Arif Habib Foundation was registered as a non-profit organization with the Government of Pakistan in 2008. Governed by a dedicated Board of Trustees, the Foundation began its journey with the aim of making a meaningful difference in the lives of thousands. It carries out a wide range of charitable initiatives, both directly and through partnerships with individuals and organizations that align with its core focus areas, which include:

- Improving access to education

- Enhancing healthcare services

- Supporting social welfare programs

- Promoting sustainable development initiatives

Arif Habib

Founder – Arif Habib Group

Mr. Arif Habib is the Chief Executive of Arif Habib Corporation Limited, the holding company of Arif Habib Group. He is also the Chairman of Fatima Fertilizer Company Limited, Aisha Steel Mills Limited, Javedan Corporation Limited (the owner of Naya Nazimabad) and Sachal Wind Power.

Mr. Arif Habib remained the elected President/Chairman of Karachi Stock Exchange for six times in the past and was a Founding Member and Chairman of the Central Depository Company of Pakistan Limited. He has served as a Member of the Privatisation Commission, Board of Investment, Tariff Reforms Commission and Securities & Exchange Ordinance Review Committee. He is currently a member of the Think-Tank constituted by the Prime Minister on COVID-19 related economic issues.

Mr. Habib participates significantly in welfare activities. He remains one of the directors of Pakistan Centre for Philanthropy (PCP), Karachi Education Initiative (KSBL) and Karachi Sports Foundation as well as trustee of Memon Health & Education Foundation (MMI) and Fatimid Foundation.

Chairman & Independent Director

Zafar Alam

With decades of experience in financial markets, Zafar Alam brings a unique blend of global leadership, innovative vision and in-depth financial knowledge. As a business leader in investment banking encompassing Origination, Trading, Sales and Asset Management he has lead teams of over 400 people and delivered revenues of over a billion dollars. He has been a key member of the Top Executive Group - TEG at ABN AMRO and RBS Bank.

Holding a master’s degree in Nuclear Physics, Zafar joined ABN AMRO as Investment Manager in Dubai. In 1988 he moved to Hong Kong as Head of ABN AMRO Securities & Finance Co., focusing on fixed income trading and sales. In 1990 he started the brokerage and origination business for Asian equities. In 1995, he was asked by the bank’s senior leadership to move to Singapore, to lead and build the local markets business, as Head of Local Markets and Credit Trading.

As a passionate innovator, Zafar Alam had the vision to enter into Fixed Income and Derivatives markets. The bank was only active in FX sphere however his input gave the direction to add Fixed Income and Derivatives as the market was set to take off in the aftermath of the Asian crisis. The activities included origination, trading and sales in thirteen Asian countries

In 2002, he was appointed Managing Director and moved to London as Global Head of Emerging Markets responsible for origination, trading and sales, before taking on his new role in Equities.

As Global Head of Equity Derivatives Sales in the enlarged RBS Global Banking & Markets Group. In this role Zafar was responsible for combining the successful Private Investor Products (PIP) and Institutional/Corporate business of ABN AMRO and RBS. He was responsible for developing, manufacturing and distributing structured products consisting of multi-assets. In one year, he turned a USD 150 million business into a USD 1 billion business.

In 2010, he become Head of Equities and Structured Retail Sales for Middle East and Africa, based in Dubai focused on building an Equities platform. He also managed the Structured Equities Solution team which provided equity financing with an overlay of derivative solutions.

Zafar Alam has always had a strong belief in technology and been a visionary for a digital future. Zafar Alam is a chairman and founder of ELIGIBLE.ai, an award winning Fin-Tech company in the UK loan servicing market. Eligible is a digital servicing solution using behavioral segmentation to personalize every consumer’s journey. Allowing financial institutions to instantly educate, empower and retain their customer base. The Fin-Tech services over GBP 15 billion in mortgages making it the 5th largest consumer database in the UK.

With the combination of his extensive experience across sectors and markets, Zafar Alam has also been entrusted as a Partner at Silver Tree HK LTD., an asset management fund based in Hong Kong with over USD 250 million assets under management (AUM).

Muhammad Shahid Ali Habib

Chief Executive Officer & Executive Director

Shahid has a proven track record of establishing successful business organizations and turning around ventures into vibrant units. He has over 25 years of experience in the fields of Securities Brokerage, Banking, Corporate Finance and Investment Banking.

He joined AHL in 2013, as Chief Executive, responsible for all investment banking and Securities brokerage activities. Shahid has worked on over 50 transactions and raised more than PKR 350 billion across equity, structured equity and bonds for both corporate and sovereign clients. He was the Domestic Team Leader of Pakistan’s largest equity market transaction, “The HBL Secondary offering” worth PKR 107 bn and others significant transactions including UBL secondary offering of PKR 41 bn and Engro Fertilizers offering of PKR 20 bn. He has also originated several M&A transactions over the years.

During his tenure, AHL was awarded ‘Best Equity Brokerage House’ multiple times by the CFA Association of Pakistan (CFAP) and Best Investment Banking House by Asiamoney and The Asset. The company also has the distinction of being awarded Best Investment Banking House for 9 consecutive years by CFAP and multiple times by Asiamoney, FinanceAsia and The Asset during Shahid’s tenure as CEO. The growth and progress made under his guidance has also been acknowledged by Pakistan Stock Exchange (PSX) with AHL the only brokerage house to be a multiple recipient of the ‘Top 25 listed companies award’.

Shahid has previously served as Executive Director and Chairman of a few local equity brokerage and financial services institutions and also worked at leading banks in Saudi Arabia and Canada. He regular serves as member of various committees at the PSX including Development and Trading Affairs Committee, New Product Committee, Companies Affairs and Corporate Governance Committee

He holds an MBA in Finance from the Institute of Business & Administration (IBA) and has a Certification in Finance from London School of Economics (LSE) as well as a Bachelor’s degree in Computer Science from FAST ICS.

Our mission and values

What We Do

To be Pakistan’s leading Investment Company which delivers both competitive financial returns together with a positive impact on the country’s economy and its people through responsible investing.